“The Federal Retirement 80% Rule”

The Federal Retirement 80% Rule (FR 80) is widely recognized as a good barometer as to whether you will be able retire when you want to and more importantly stay retired without having to change your lifestyle. The premise is simple; if on the day after you retire, your Gross Income is 80% of what is was on the day before you retired, you should be all set. But even at that there are exceptions to the FR 80 Rule that could negatively impact your “Bullet-Proof” Federal Retirement, such as Uncovered Medical Expenses, Nursing Home and In-Home Care, Stock Market Declines, Projected Decreases in Social Security and of course Inflation.

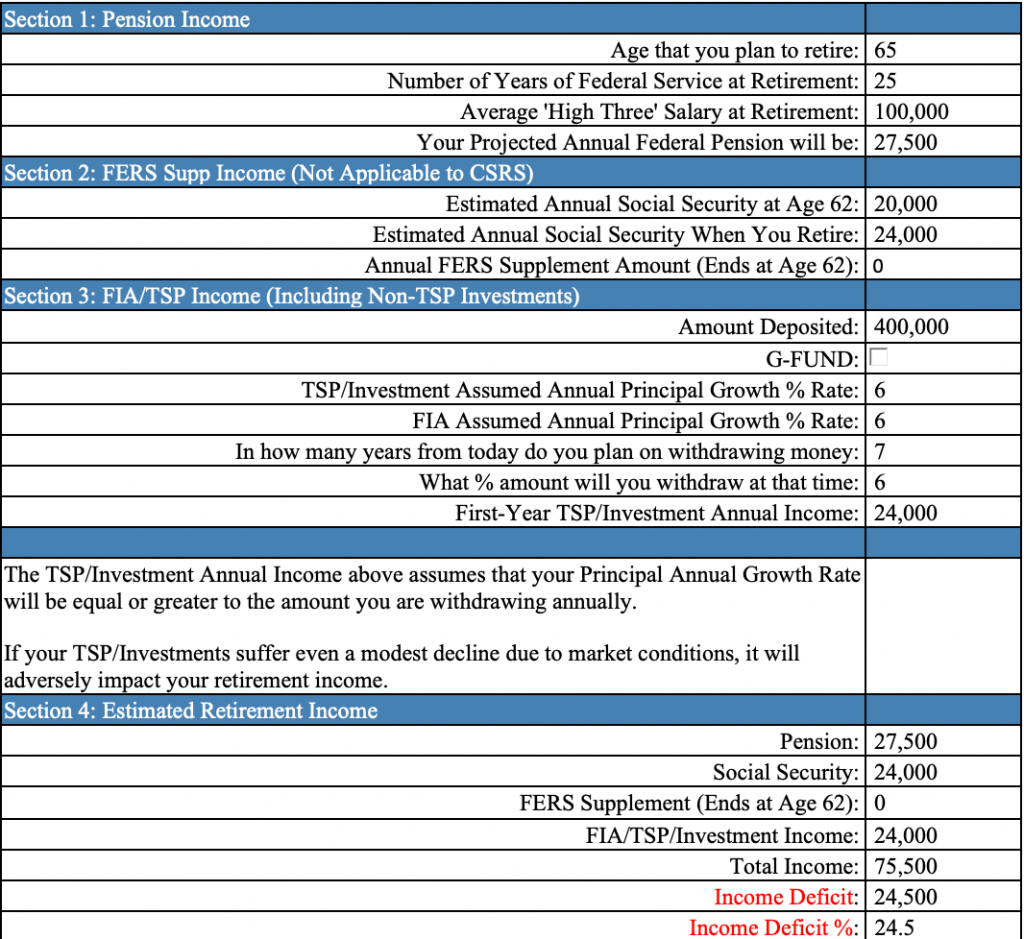

We created an FR 80 Calculator that will show you any retirement fund, or retirement income shortfalls you might encounter in the future and how to remedy them. Below is an actual Case Study of a federal employee who wanted to retire at age 65 with 25 years of federal service. At the very bottom the Income Projection Chart you will see that the Projected Income Deficit at retirement will be $24,500, which is a significant deficit to overcome.

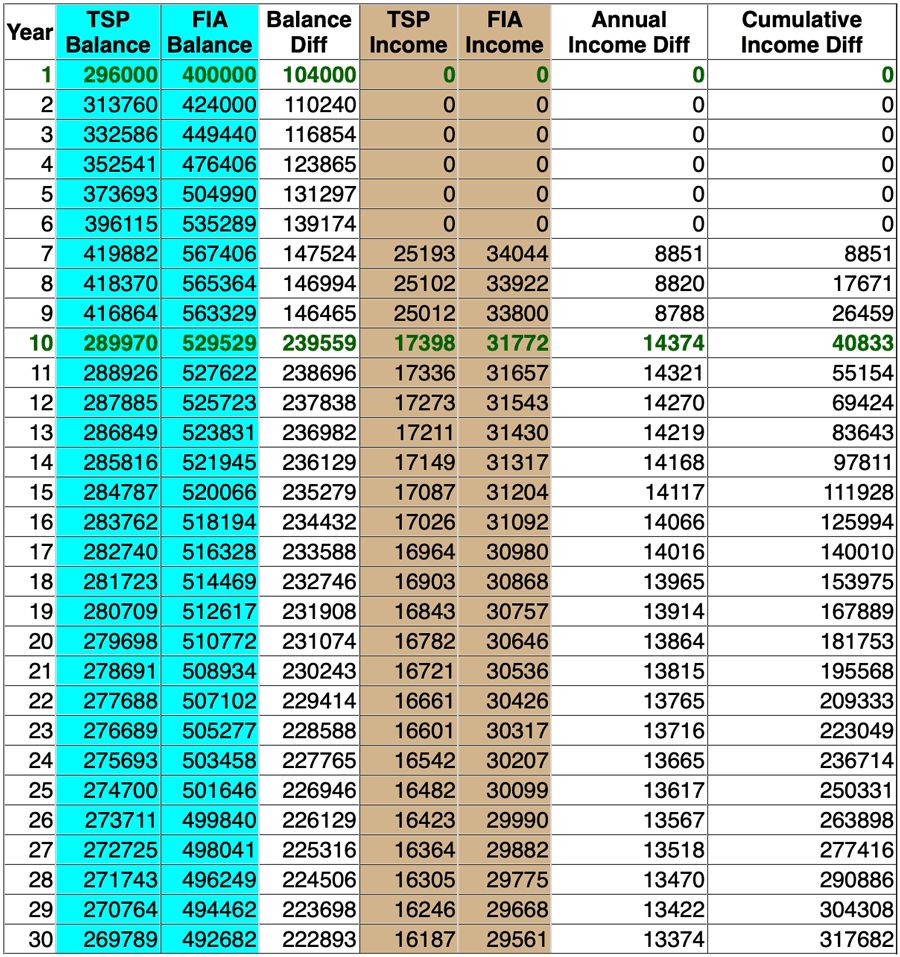

If you are more concerned about “Capital Growth” and “Capital Preservation”, than you are about Income, note the figures illustrated on the TSP Growth Projection Chart, focusing on year10, where there is a $182,105 difference between the TSP amount and the “FIA” alternative. We also offer a solution for that “Problem” as well, but not through Federal Retirement Shield.

FR 80 Calculator (Income Projection)

FR 80 Calculator ( TSP Growth Projection)